TL;DR

- Perpetual trading is heating up again, with daily volumes hitting $28.3B and monthly volumes topping $1.31T (DefiLlama).

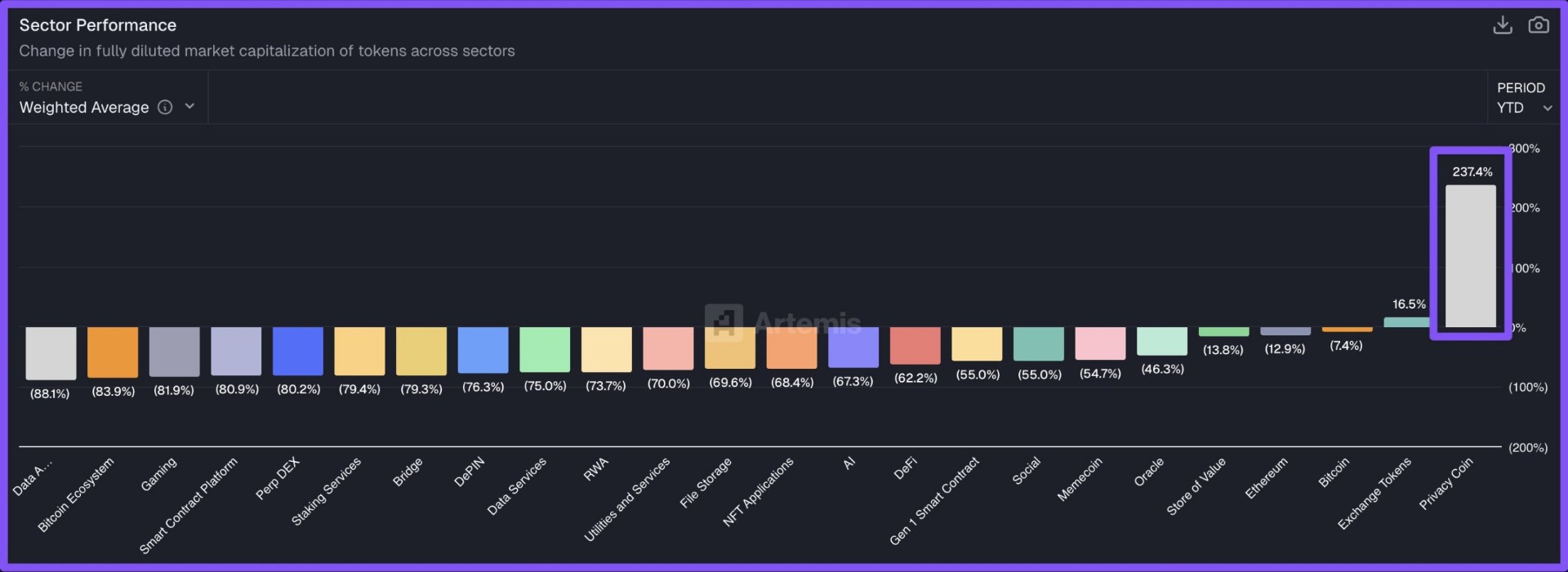

- The privacy-tokens sector is the fastest-growing category year-to-date, according to Unfolded.

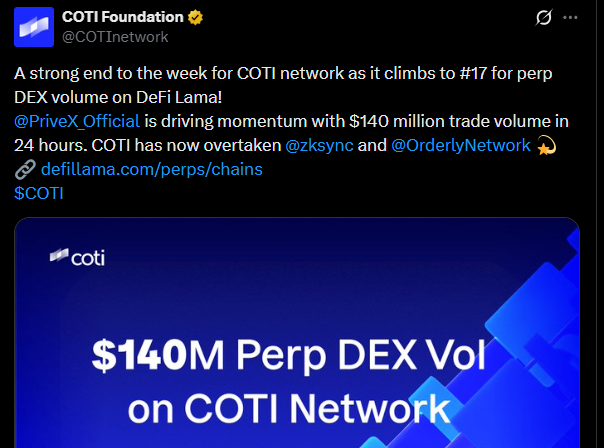

- COTI's privacy-first perp DEX, PriveX, delivered $140M in 24-hour volume - pushing COTI above zkSync, Orderly, and even Sui.

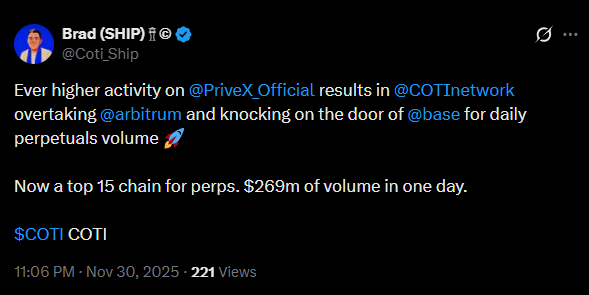

- In the next targets list: Arbitrum and Base. COTI already overtook Arbitrum in daily perpetuals volume and is now approaching Base.

The market has been quietly reshaping itself over the past few months. Perpetual futures - once dominated by a handful of established platforms - are surging again. According to DefiLlama, the numbers are back in levels we haven't seen in a long time: $28.325B in daily perp volume and a staggering $1.317T in monthly volume.

This isn't just a data bump. It signals a clear appetite for leverage, speed, and asset diversity. And while total perp volume grows, another trend is unfolding behind the scenes - privacy is coming back to the center of crypto conversations. According to Unfolded,

That shift sets the stage for what's happening with COTI right now. Because while the market was looking at the usual names - Sui, zkSync, Arbitrum, Base - something else was happening: COTI quietly started overtaking them. And it's happening fast.

The Rise of PriveX

If there's one product reshaping COTI's trajectory, it's PriveX, the chain's privacy-focused perpetuals DEX integrating perps + privacy + AI. PriveX didn't enter with noise or marketing fireworks. It launched quietly, iterated quickly, built a strong trader base, and began reporting numbers that forced the market to pay attention.

Recently, the COTI team shared a milestone that turned heads:

The message was direct - COTI isn't just competing. It's surpassing networks that entered the narrative with larger ecosystems and much bigger marketing budgets. But the more interesting part is the pattern:

PriveX is breaking new volume records almost daily. That consistency matters more than any one-day spike.

This Is Just the Beginning - The Team Speaks

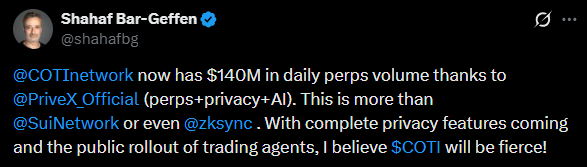

After the milestone, COTI CEO Shahaf Bar-Geffen posted a message that gave the community a glimpse of what's coming next:

There are two key signals in that statement:

1. Complete privacy features are coming

COTI V2's architecture was built around confidential computation. When PriveX plugs into those features fully, it moves into a category that no other perp DEX occupies right now - fully private orderflow and trader behavior.

2. Trading agents open a new frontier

AI-powered trading agents aren't just a gimmick. They bring:

- Automated strategies

- Custom execution logic

- Reduced manual error

- A bridge between AI automation and on-chain settlement

Combine that with privacy, and you're looking at something completely new in the perp DEX landscape.

COTI Overtakes Sui and zkSync - Quietly

COTI's recent climb in the perpetuals rankings didn't arrive with flashy campaigns or loud announcements. It happened in a steady, almost quiet way - driven by a real spike in on-chain activity from PriveX. The jump became impossible to ignore when COTI suddenly appeared above Sui and zkSync in daily perp volume, backed by $140M flowing through PriveX in just 24 hours.

This shift says a lot about where users are heading. People are gravitating toward trading environments that offer privacy by default, low friction, and a sense that they're early to something meaningful. PriveX fits that moment. What looked like a small experiment inside COTI is now reshaping how traders interact with perp markets - especially those who don't want every move broadcast on a block explorer.

COTI's team framed the milestone clearly. They highlighted how the network climbed to #17 for perp DEX volume on DeFiLlama, while PriveX kept delivering new highs. It's rare to see a new chain quietly surpass ecosystems that spent months building narrative strength. But when traders find real utility - speed, privacy, and now AI-driven execution - the volume naturally moves. COTI's jump past Sui and zkSync signals something deeper: users aren't just testing PriveX; they're sticking with it.

Who's Next for COTI to Overtake?

With Sui and zkSync already behind, the obvious question becomes: who's next? Activity on PriveX isn't slowing down - it's accelerating, and every day adds a new high. That momentum pushes COTI directly into the territory of chains that have long owned the perp-market conversation: Arbitrum and Base.

Arbitrum has dominated the L2 landscape for over a year, especially in derivatives. Base has been rising fast with strong retail energy and Coinbase-powered visibility. But neither is immune to disruption, and PriveX is now showing volume patterns that challenge both. Just a day ago, PriveX hit $269m of volume in one day. When a chain starts posting $250M-$270M days - consistently - the rankings reshuffle faster than people expect.

COTI's BD lead, Brad, captured the moment perfectly on X he shared his take:

The message wasn't hype - it reflected a measurable trend. If PriveX continues to grow at this pace, overtaking Arbitrum or Base becomes less of a speculation and more of a timeline. The rise isn't about marketing; it's about traders migrating to a setup that gives them speed, optional privacy, and soon AI-powered execution.

COTI isn't positioning itself as a competitor to the big L2s. It's building a lane of its own - a lane that mixes confidential trading with automated intelligence. And if daily volumes keep trending upward, the next overtakes might happen the same way the last ones did: quietly at first, then impossible to ignore.

Why Privacy Matters in Perp Markets

Perp trading is competitive. Traders don't want their strategies exposed. They don't want open order behavior tracked. And they definitely don't want their positions analyzed by MEV bots. Privacy isn't a niche add-on here - it's an edge.

COTI's architecture brings:

- Confidential execution via garbled circuits

- Private orderflow

- Reduced front-running

- Minimized information leaks

- Secure agent-driven execution

Most perp DEXs treat privacy as an afterthought. COTI builds it into the foundation. That design choice is now paying off.

The COTI Advantage Going Forward

-

Privacy + Perps + AI in one stack

COTI isn't competing with single-feature chains. It bundles privacy, efficient execution, and AI-driven tools - a combination users are actively moving toward.

-

PriveX delivering real, consistent volume

This isn't hype volume or one-off spikes. PriveX keeps posting new highs, proving product-market fit before full privacy features are even live.

-

Clear demand for privacy-enabled trading

With data showing privacy tokens as the fastest-growing sector this year, COTI is positioned directly in the strongest market narrative.

-

Fast growing developer and user visibility

Each new volume milestone pushes more traders, builders, and analysts to look at COTI - reinforcing an adoption loop.

-

Upcoming trading agents and full privacy rollout

The roadmap includes features that add even more edge, especially automated strategies powered by AI and privacy-preserving execution.

Looking Ahead

The interesting part about COTI's rise is how early it still is. PriveX has only started scaling, privacy features aren't fully activated yet, and trading agents haven't gone public. Despite that, COTI is already overtaking major networks in a core metric - perp volume - without aggressive incentives or large marketing budgets.

If the team keeps delivering at this pace, the chain moves from "underrated" to "inevitable" very fast. Markets tend to reward consistency, and PriveX is proving that it can post new highs almost every day. The next milestones - surpassing Base, expanding liquidity sources, rolling out complete privacy, opening AI-driven trading tools - all point toward a chain stepping into a new tier of relevance. It feels like the narrative is shifting, but the numbers shifted first.