TL;DR

- SEC set to decide on 16 crypto ETFs in October covering Solana, XRP, Litecoin, Dogecoin, and more.

- First deadline: Canary’s Litecoin ETF on Oct. 2, last: WisdomTree’s XRP ETF on Oct. 24.

- Nate Geraci: “Enormous next few weeks for spot crypto ETFs.”

- James Seyffart lists final deadlines; says SEC could act anytime before.

- Daan Crypto calls October “ETF month” but notes BlackRock and Fidelity are absent.

- Bloomberg ETF analysts see high chance of approvals in 2025.

The U.S. Securities and Exchange Commission (SEC) faces a packed calendar next month as 16 different crypto ETFs hit final decision deadlines. The products include exposure to major altcoins such as Solana (SOL), XRP, Litecoin (LTC), and Dogecoin (DOGE). The staggered deadlines run from October 2 to October 24, making October one of the busiest periods yet for crypto ETF applications.

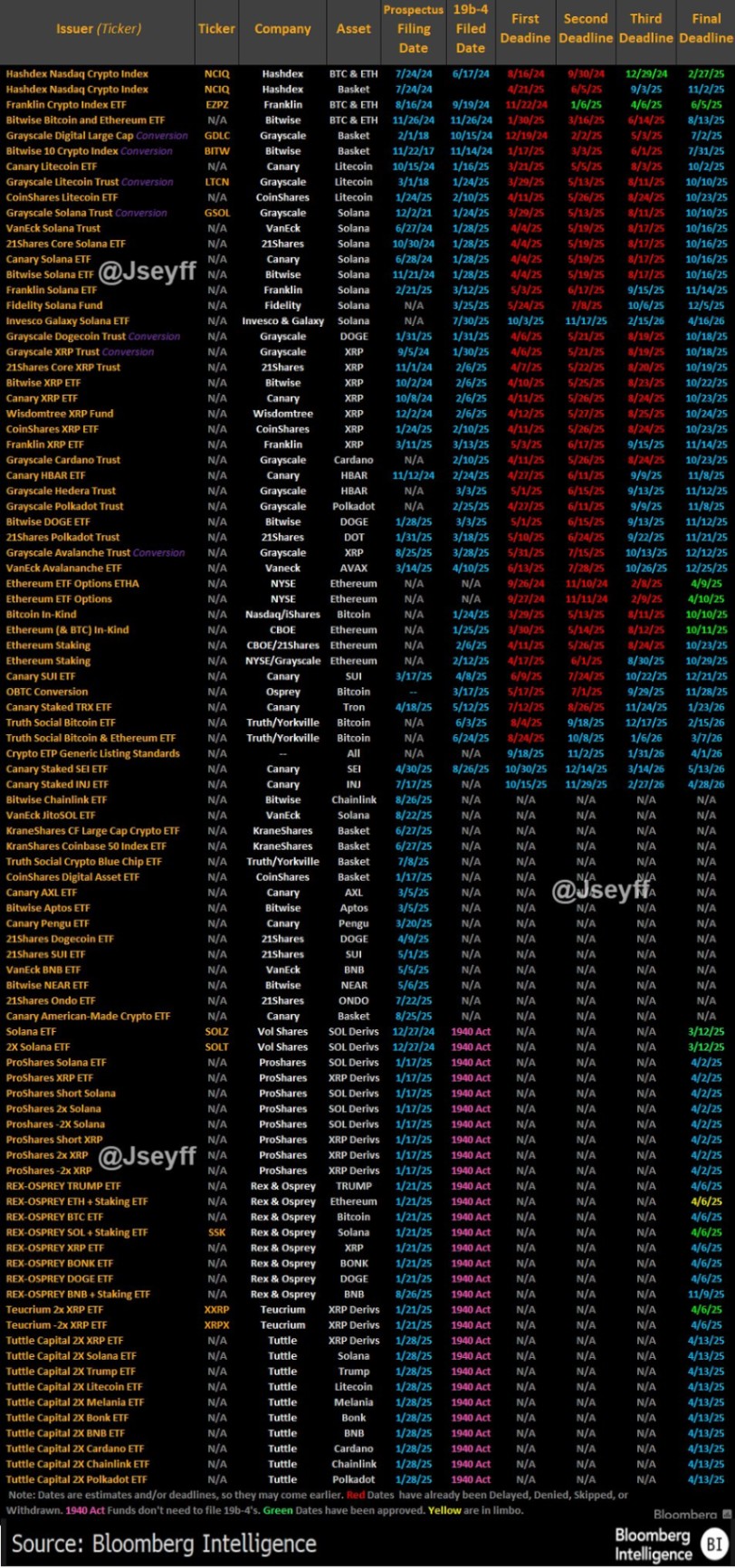

Source: James Seyffart shared

ETF analyst James Seyffart shared a list of the deadlines, showing Canary’s Litecoin ETF first in line on October 2, Grayscale’s Solana and Litecoin trust conversions on October 10, and WisdomTree’s XRP ETF closing out the month on October 24.

Importantly, Seyffart noted the SEC can issue decisions at any point before the deadline, meaning approvals or rejections could arrive earlier than expected.

Nate Geraci: “Enormous Next Few Weeks”

Nate Geraci, president of NovaDius Wealth Management, described the upcoming period as crucial for crypto markets.

In a post on X, Geraci said:

ETF approvals have historically been significant market catalysts, often signaling institutional confidence and providing easier access for retail investors who prefer regulated products.

Daan Crypto: “ETF Month” Without Big Names

Crypto trader Daan Crypto Trades called October “ETF month,” highlighting the sheer number of decisions due. At the same time, he pointed out that the biggest players are not in the mix:

While BlackRock and Fidelity dominate the Bitcoin ETF space, their absence here means the October batch consists largely of smaller issuers and niche products. Still, analysts believe these funds could pave the way for broader acceptance of altcoin ETFs.

Altcoins in the Spotlight

The deadlines cover a diverse mix of tokens:

- Litecoin (LTC): Canary’s ETF leads the pack with an October 2 deadline.

- Solana (SOL): Grayscale’s Solana trust conversion is due October 10.

- Dogecoin (DOGE): A proposed fund tied to the popular memecoin is awaiting its ruling mid-month.

- XRP: WisdomTree’s ETF closes the month on October 24.

- Other projects like Cardano (ADA) and Hedera (HBAR) are also on the list.

If approved, these ETFs could make it significantly easier for U.S. investors to get regulated exposure to these networks, potentially boosting liquidity and price stability.

Bigger Picture: SEC Under Pressure

The SEC is facing mounting pressure to provide regulatory clarity for crypto. After losing several legal challenges, including cases tied to Bitcoin ETFs, the agency has fewer grounds to delay or reject applications without strong justification.

Approving a slate of altcoin ETFs would mark a major milestone, signaling that the SEC is open to regulated investment products beyond Bitcoin and Ethereum.

Market Expectations

Back in June, Seyffart gave long-term odds of 90% or higher for crypto ETF approvals in 2025. (Source)

That said, October may not see a flood of green lights. The SEC has historically delayed decisions until the last possible moment and often prefers to approve multiple products at once to avoid picking winners. Investors should also remember that approval doesn’t guarantee immediate price surges. Markets often price in expectations, and ETFs still face adoption hurdles.

What’s Next

With deadlines spanning the entire month, October could bring a steady stream of market-moving headlines.

The key dates:

- Oct. 2: Canary Litecoin ETF deadline

- Oct. 10: Grayscale Solana & Litecoin trust conversions

- Oct. 24: WisdomTree XRP ETF deadline

Whether the SEC opts for a wave of approvals, selective green lights, or more delays, the crypto industry will be watching closely.

ALSO READ: No More Front-Running: Why COTI V2 Might Just Save DeFi