TL;DR

- Traders still face front-running, MEV bots and strategy-leaks on many on-chain perp platforms.

- PriveX, built on the COTI Privacy Network, uses intent-based architecture to offer private, efficient trading.

- On Oct 28 PriveX announced three major upcoming features: Privacy Mode (fully confidential transactions), full Encryption of trade parameters (price, size, liquidation details) and AI Agents (automated strategy bots).

- These updates deepen privacy, reduce trade exposure, improve automation and bring on-chain experience closer to institutional standards.

- The platform is already gaining traction: trading volumes surged from $100 M to $200 M in just 14 days, hitting $10 M+ daily volume.

It may sound ironic, but even when you trade "on-chain" you're often exposed. Imagine placing a large leveraged trade and seeing bots jump in front because your intent is visible. Or a liquidation target showing up in the public mempool before you've even pressed the button. That's the reality for many derivatives traders in decentralised finance (DeFi).

Despite the promise of self-custody, transparency and permissionless access, the derivatives market still tilts toward centralised exchanges (CEXs). On-chain models lag in execution, liquidity and protection. Slippage, leakage and strategy exposure remain major hurdles. The market demands something that feels like the execution speed and UX of a CEX-but with the trust, control and openness of DeFi.

That gap is exactly what PriveX is going after.

What is PriveX?

PriveX is a perpetual-trading platform built on the COTI Privacy Network. It uses an intent-based architecture: you simply express what you want to do-long 1 BTC at 10× leverage, swap X for Y, or deploy an automated strategy-and the system handles how to execute that intent. Liquidity is matched via solvers, execution happens on-chain, and your strategy stays hidden until settlement.

Importantly, PriveX also leans into privacy technology via COTI's "garbled circuits" layer, which means trade details-your entry, stop-loss, liquidation thresholds-are encrypted or shielded. The result is a trading experience that seeks the best of both worlds: centralised-style performance + decentralised-style trust and control.

The Big Reveal: October 28 and What's Coming

On October 28, PriveX posted a major update signaling upcoming feature releases:

The three headline features:

- Privacy Mode Feature - Every transaction becomes confidential, user data protected, large trades executed without slippage or exposure. The intent-based mechanism removes public liquidity pools.

- Encryption of Trade Parameters - Everything visible today (order price, size, liquidation levels, margin) gets encrypted. Your intent is only revealed at settlement.

- Creation of AI Agents - Users will be able to create autonomous trading agents: name one, select agent type, write a brief bio-and the agent trades on your behalf.

Let's dive into each of these in turn-what they mean, how they'll work, and why they matter.

Feature 1: Privacy Mode - Trading Without the Spotlight

When you place a trade on many platforms, your intention is visible to someone-bots, front-runners, miners, validators. If you're making a large move (say 10× leverage on BTC), your intent might trigger slippage, early liquidation or other predatory behaviour. Privacy Mode seeks to eliminate that.

Under this mode, all transactions become essentially "silent": your order parameters, size, stop-loss conditions, even your choice of solver or counterparties remain confidential until trade settlement. The intent-based architecture already shifts the focus from how the trade is done to what the trade is for. With this privacy layer, the "how" also stays hidden.

This means fewer surprises. Bigger trades can happen without the spotlight. Large volume won't be penalised via price impact. That opens the door for institutional size with on-chain permissionlessness. For users it means: you trade, your strategy stays yours.

Feature 2: Full Encryption of Trade Parameters

In most DeFi models today, these pieces of a trade are visible: your limit price, the quantity you're trading, your liquidation margin, the collateral you post. This transparency is good for trust-but bad for stealth. If your strategy is visible, you lose edge.

PriveX's upcoming encryption upgrade takes these once-public data points and locks them behind the system until execution completes. For example: your order limit price remains hidden; your collateral posted remains hidden; your solver counterparty remains hidden. What others see: nothing until the trade is done and settled.

How this works in practise: you input the parameters, the solvers quote you in a private environment, execution happens when you accept, and only then does settlement and transparency kick in. This obscured path means fewer bots can front-run you. It means your liquidation trigger isn't broadcast ahead of time. It means you retain control of your strategy narrative.

The benefit is clear: better protection, lower risk of being targeted, fewer invisible costs. For many traders, that protection is becoming non-negotiable.

Feature 3: Create Your Own AI Trading Agent

Perhaps the most forward-looking feature of the three is the AI-agent builder. PriveX will allow users to spin up autonomous agents in a few steps: choose a name, select type, define a bio-then the agent trades independently. Behind the scenes, these agents will execute your intents, monitor markets, hedge positions, manage exposure.

Why this matters: it brings automation to on-chain trading without forcing you into the weeds. You don't need to code the entire strategy; you define an agent concept, and it executes. This lowers the barrier to algorithmic trading, especially in the privacy-enabled environment PriveX offers.

It also signals a vision: trading isn't just manual trades anymore. It becomes an orchestration of smart agents, strategies, and vaults. Because PriveX hides your strategy, your agent can execute novel approaches without broadcasting its logic. That's a big step for anyone serious about automated trading on-chain.

Achievements So Far: The Traction Story

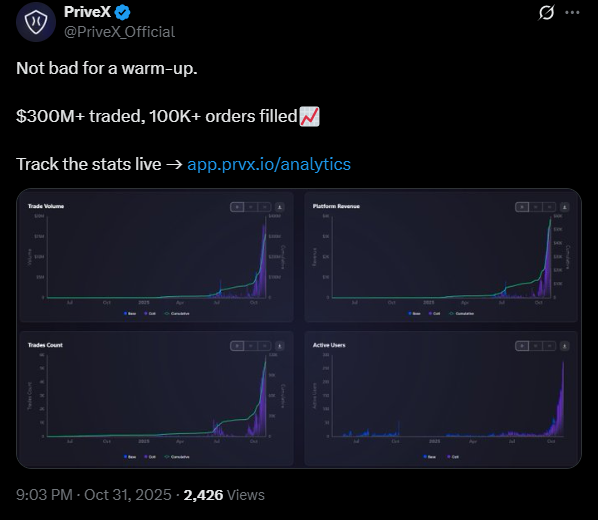

While the future features are exciting, they build on real momentum. PriveX has already showed signs of accelerating adoption. According to public updates:

- Within a recent 30-day window trading volume grew by 1323 %.

- Daily volume passed $10 M+ for the first time.

- Monthly volume in one stretch doubled from $100 M to $200 M in just two weeks.

- Recently PriveX posted on X:

That kind of trajectory matters. It shows the platform isn't just theoretical-it's gaining users and handling real volume under its privacy-first architecture. The upcoming feature set therefore sits on a foundation of growth, not just promises.

Why These Features Make a Difference

You might ask: "Are these just nice extras?" Not quite. The upcoming features combine to tackle key barriers that have kept many traders away from on-chain derivatives.

Visibility = Vulnerability: When your trades are exposed, your risk is higher. Privacy Mode and encryption reduce that.

Liquid, efficient execution matters: If you trade large size, slippage and liquidity fragmentation kill profits. Intent-based architecture + solver network + private execution means better pricing and deeper accessibility.

User empowerment through automation: AI-agents let you scale strategy without coding or constant supervision. In a privacy environment, these strategies retain value and secrecy.

Bridging CEX performance with DeFi control: Many traders left DeFi for CEXs because they wanted speed and ease. These features bring the ease, privacy and performance to DeFi.

In short: for traders who care about size, stealth, strategy and control-these features aren't optional-they're essential.

Final Thoughts

The next evolution of on-chain trading is being written right now. PriveX is positioned at a pivotal junction where privacy, automation and intent-based execution meet. The features announced on October 28 are not just incremental-they signal a shift in how on-chain derivatives trading can function.

Privacy Mode, encryption of trade parameters and AI agent deployment together form a compelling upgrade. Combined with PriveX's growth so far, the platform is making its mark. That doesn't mean all risk vanishes-liquidity dynamics, platform maturity and regulatory shifts still matter-but for any trader who has felt exposed, underserved or limited in the current on-chain options, the future just got more interesting.

If you're wondering whether on-chain derivatives are ready for prime time yet-you might want to pay attention to PriveX. The board is being reset, and with these features incoming, the game just changed.