TL;DR

- Wallet in Telegram teams up with Kraken and Backed to launch 60 tokenized US equities via xStocks.

- Rollout begins in October 2025, starting with 35 stocks including Nvidia, Coinbase, and Robinhood.

- Expansion to TON Wallet is set for Q4 2025, making the service self-custodial.

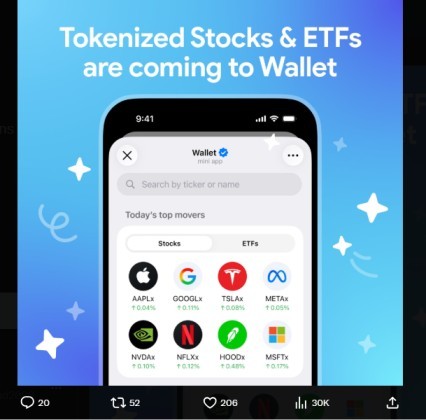

The line between traditional finance and crypto just blurred even further. Wallet in Telegram, the popular crypto wallet built into the messaging app, has announced a new integration with xStocks, bringing tokenized versions of US stocks and ETFs directly into Telegram.

The initiative is powered by Backed, the operator behind xStocks, and supported by Kraken, the US-based crypto exchange. Users will soon be able to trade tokenized shares of household names such as Nvidia (NVDA), MicroStrategy (MSTR), Coinbase (COINX), and Robinhood (HOODX) - all without leaving the Telegram ecosystem.

"The rollout will start in a limited number of markets as we carefully test adoption and user experience," a Wallet in Telegram spokesperson told Cointelegraph. The focus, they emphasized, is on balancing compliance with accessibility, gradually scaling the product to more users.

What Exactly Is Being Offered

Source: Telegram

Starting in October 2025, a new "Stocks and ETFs" section will appear inside Wallet in Telegram. The first wave will include 35 tokenized equities, with plans to scale to 60 by year's end.

Among the listings:

- Circle (CRCLX)

- Coinbase (COINX)

- Robinhood (HOODX)

- TON Strategy (TONx)

- Nvidia (NVDA)

- MicroStrategy (MSTR)

Notably, Bitcoin ETFs will not be part of the initial lineup.

This distinction matters. Tokenized equities are not the same as traditional shares - they are on-chain representations of real-world assets, making them easier to trade across borders and outside conventional stock market hours. Still, issuers must navigate regulatory boundaries carefully, which is why Wallet in Telegram is beginning cautiously.

Expansion to TON Wallet

For now, the rollout is limited to the custodial version of Wallet in Telegram. But the real shift comes later: by Q4 2025, the team plans to expand availability to TON Wallet, the self-custodial wallet built on The Open Network (TON). This means users will eventually control their tokenized equities directly, without relying on intermediaries - a step closer to true decentralization.

The Bigger Picture: Tokenization Trend

This launch is part of a much larger trend. Tokenization of real-world assets (RWAs) has become one of the most talked-about themes in crypto.

By making equities tradable on-chain, platforms like xStocks aim to:

- Lower barriers for investors in underserved markets.

- Enable trading outside of traditional stock market hours.

- Reduce costs compared to traditional brokerage services.

For Telegram, which already has over 900 million active users, embedding tokenized stocks directly into its ecosystem could represent one of the biggest pushes for mainstream adoption of tokenization yet.

Why It Matters for TON

The TON blockchain is already seeing a surge in development - from DeFi protocols to gaming apps. Bringing tokenized stocks into Wallet in Telegram ties directly into TON's ambition of being the consumer-facing blockchain for everyday users.

Once the expansion to TON Wallet rolls out, the project could become a case study for how tokenization meets self-custody, bridging the gap between Web2 interfaces (like Telegram) and Web3 infrastructure (like TON).

Final Thought

Tokenized assets are moving from niche experiments into mainstream messaging platforms with global reach. The decision to focus on emerging markets, expand into self-custody, and prioritize compliance shows a careful, strategic rollout. If successful, Telegram could become not just a messaging app, but a gateway to global financial markets for millions of new investors.

The age of tokenized finance isn't coming - it's already starting to unfold inside the apps we use every day.

READ MORE : What is COTI V2: Revolutionizing Blockchain Privacy with Garbled Circuits