TLDR (Quick Summary)

- Carbon DeFi is a next-generation onchain trading engine built by Bancor and deployed on COTI.

- It gives traders full control through limit orders, range orders, recurring strategies, and auto-compounding concentrated liquidity - all onchain.

- No slippage, immunity to MEV sandwiches, and 100% price certainty make it fundamentally different from traditional AMMs.

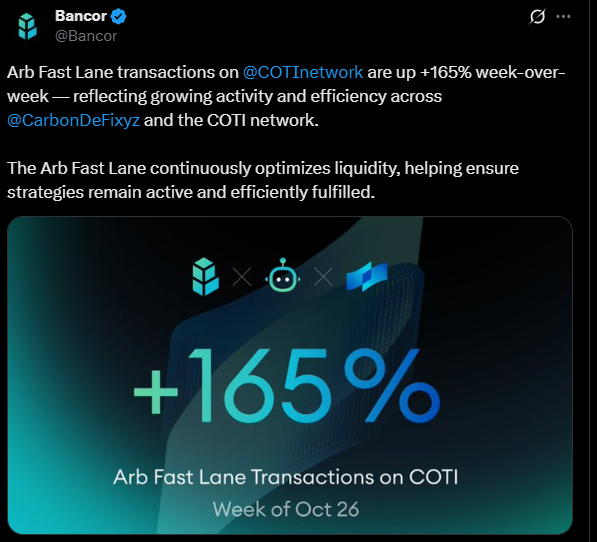

- Bancor's Arb Fast Lane optimizes liquidity in real time, with transactions on COTI up 165% week-over-week.

- Carbon DeFi is 20,000,000x more capital efficient than standard liquidity pools and 1,000x more efficient than concentrated AMMs.

- COTI adds confidential computation, protecting strategies from front-running and keeping trade logic private.

- Together, Carbon DeFi + COTI form one of the most advanced trading environments in all of Web3 - built for people who want precision, automation, and real control.

DeFi promised a world where anyone could trade, earn, and build without middlemen. But in reality, most traders still fight the same old problems: unpredictable execution, constant MEV threats, rigid AMM designs, and strategies that break the moment markets move too fast. Even the smartest users end up relying on bots, off-chain workarounds, or CEX tools just to stay competitive.

Carbon DeFi steps into that gap with something the industry has been waiting for: a DEX built around strategy, not just swaps. It gives traders the ability to set exact prices, automate orders, scale positions gradually, and capture volatility all on-chain, all without code, and without exposing themselves to MEV. When paired with COTI’s confidential computation layer, Carbon becomes even more powerful: traders finally gain both the precision and privacy needed to operate intelligently in open markets.

Now let’s go deeper into how Carbon DeFi works and why it’s redefining the way people interact with on-chain markets. Let’s unpack how Carbon DeFi is changing DeFi itself, and more importantly, how it helps you trade smarter..

The Bancor Legacy: The Original DeFi Innovator

Decentralized finance (DeFi) has transformed the way we think about money, trading, and capital allocation. Yet despite its explosive growth, traders often face friction, inefficiencies, and risks on both centralized exchanges and traditional AMM-based decentralized platforms. From slippage to front-running, from rigid liquidity constraints to limited automation, the tools available have long constrained the average trader’s potential.

Enter Carbon DeFi, the next-generation decentralized exchange powered by Bancor and integrated with the COTI network - a platform designed to give traders precision, flexibility, and confidence previously thought impossible on-chain. To understand why Carbon DeFi is different, you need to understand where it comes from.

Bancor has been building liquidity infrastructure since 2016 - long before DeFi even had a name. Bonding curves, pool tokens, and the AMM model many protocols use today? Bancor helped pioneer them. Now, years later, instead of competing with copycats, Bancor has launched its most advanced system yet: Carbon DeFi. It's a platform that breaks apart the rigid structure of AMMs and replaces it with strategy-based, programmable liquidity. And launching on COTI's network gives it the privacy and execution environment needed for a new era of DeFi.

What Exactly Is Carbon DeFi?

Carbon DeFi is a strategy-first DEX where you control how your liquidity behaves. Instead of one liquidity curve, one swap path, or one predictable model, Carbon gives traders the ability to create:

- Exact-price limit orders

- Customizable range orders

- Auto-compounding concentrated liquidity positions

- Buy-low/sell-high looping strategies

- Onchain automation without bots

It's flexible, predictable, and constructed entirely around user-defined logic. The platform goes further, integrating a high-frequency execution system called Arb Fast Lane, which monitors both Carbon DeFi and other DEXes to capture arbitrage opportunities and maintain network-wide price alignment. Most importantly, it's now powered by COTI's confidential computation - meaning strategies stay private until the moment they execute.

Why Carbon DeFi Exists: Limitations of Traditional AMMs

Decentralized finance (DeFi) has grown rapidly over the past several years, but much of its expansion has relied on automated market makers (AMMs) that, while revolutionary at the time, impose structural limitations on traders and liquidity providers. Traditional AMMs simplify trading by using liquidity pools and pre-set formulas to determine pricing, but this simplicity comes at a cost. Traders have little control over the exact execution price of their trades, often experiencing slippage in volatile markets.

Liquidity providers face similar constraints: their capital is spread uniformly across price ranges, which can be inefficient, leaving potential yield untapped. Moreover, these AMMs often expose participants to predatory strategies like front-running and MEV (Miner Extractable Value) attacks, creating hidden costs that can erode profits and disincentivize active participation.

Carbon DeFi was conceived to address these pain points, offering a new paradigm in which users regain control over their trades, liquidity deployment, and strategy execution. By introducing on-chain limit orders, range orders, recurring orders, and auto-compounding concentrated liquidity, Carbon DeFi empowers traders to define precise entry and exit conditions, capture market volatility, and maximize capital efficiency. The platform's architecture combines automation with flexibility, allowing strategies that would be impossible or risky on conventional AMMs. In essence, Carbon DeFi bridges the gap between the ease of AMMs and the sophistication of professional trading, giving users both control and protection while maintaining the decentralized ethos that underpins DeFi.

The Core Features That Change Everything

1. True Onchain Limit Orders - With Exact Price Control

Most DEXs simulate limit orders through bots or external systems. Carbon executes them natively, directly onchain - with no intermediaries and no code needed.

You select the exact price you want. When the market hits that price, Carbon executes - with 100% price certainty. This alone places Carbon in a category few protocols can match.

2. Range Orders: Gradual Scaling for Humans, Not Bots

Market conditions don't move in a perfect line. Range orders allow traders to scale into or out of positions over a chosen price band. It's ideal for:

- DCA-out strategies

- Gradually taking profit

- Avoiding cliff-edge orders that miss opportunities

- Reducing volatility-induced whipsaw losses

This level of control is rare in DeFi, and Carbon does it without needing a vault, bot, or third party.

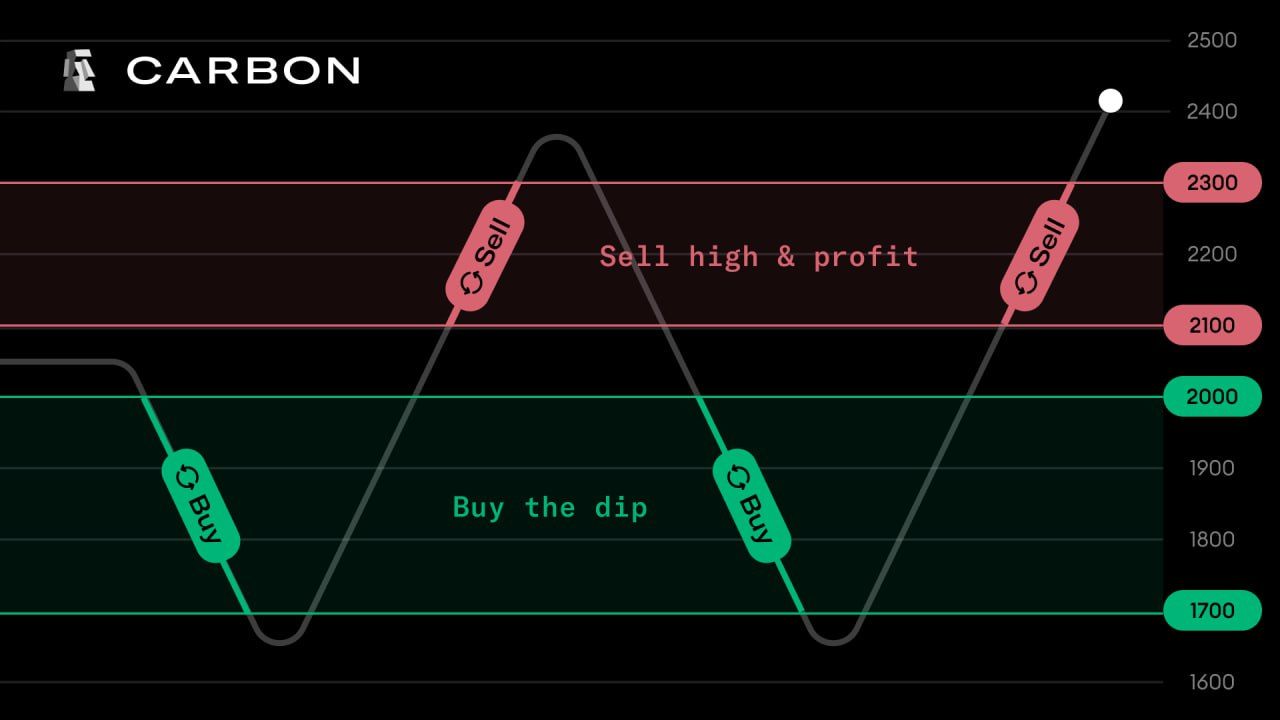

3. Recurring Buy-Low/Sell-High Strategies

The holy grail of trading is automating the cycle. Traditional AMMs don't let you do that. CEXs let you approximate it, but bots and fees eat into performance. Carbon solves this at the liquidity level. You set:

- A buy range

- A sell range

- The repeat condition

Whenever one order fills, the proceeds loop into the opposite order. It's continuous, onchain, and doesn't need your attention. This is where Carbon moves from "DEX" to "trading automation framework."

4. Auto-Compounding Concentrated Liquidity

Uniswap V3 introduced concentrated liquidity - but left a lot of manual work in place. Claiming fees, compounding them, adjusting ranges… It's powerful but tedious. Carbon simplifies this: Auto-compounding is native to the protocol, no external vaults needed.

That means:

- Higher capital efficiency

- Increased returns over time

- Greater control

- No additional risk from third-party vault providers

Combine that with COTI's privacy layer, and strategies become both powerful and protected.

Carbon's Greatest Strength: The Arb Fast Lane

Every DEX claims to be fast, efficient, and fair, but in practice, very few can maintain healthy pricing without relying on opportunistic traders or external bots. What Carbon DeFi does differently is embed an industrial-grade arbitrage engine directly into the protocol-a system Bancor calls the Arb Fast Lane. This architecture isn't a side feature; it's the backbone that keeps Carbon strategies alive, efficient, and profitable across market conditions.

At its core, the Arb Fast Lane continuously monitors price discrepancies across Carbon strategies and major DEXes on the chain. Instead of waiting for arbitrageurs to notice inefficiencies, the Fast Lane proactively identifies them at the marginal price frontier, then executes the optimal trade instantly. That approach turns Carbon into a self-stabilizing DEX, where execution is not left to chance or external incentives but is guaranteed by an always-on solver system running at high frequency.

The impact is already visible on-chain. According to Bancor:

The surge reflects rising efficiency, faster price alignment, and healthier liquidity across Carbon strategies deployed on the COTI network. As more strategies activate, the solver has more opportunities to rebalance markets, eliminate stale prices, and ensure trades clear at the intended levels. Traders experience fewer failed orders, liquidity providers capture tighter spreads, and the overall execution layer becomes more predictable.

Technically, the Arb Fast Lane is built to outperform legacy arbitrage systems by a wide margin. Traditional arbitrage relies on external actors scanning for price differences, submitting competing transactions, and paying high gas fees to win block space. In contrast, Carbon's Fast Lane is integrated directly into the DEX's logic, giving it privileged access to state changes and removing the race dynamics entirely. It evaluates opportunities with 15-decimal precision and executes with near-instantaneous finality, producing results that external bots simply can't match.

Capital Efficiency That Sets Records

Capital efficiency has been a persistent weakness in DeFi since the first AMMs appeared. Most liquidity sits idle, spread thin across wide price ranges, exposed to impermanent loss, or locked in positions that rarely earn meaningful fees. Traders pay slippage, LPs absorb volatility, and the entire system struggles to use capital intelligently.

Carbon DeFi breaks that cycle by letting users direct liquidity with surgical precision. Its architecture is built on adjustable bonding curves and asymmetric liquidity mechanics - an evolution of Bancor’s early research but refined into a system where every token deposited can be targeted, concentrated, and recycled through automated strategies. In practice, this means one unit of liquidity can do more work, generate more opportunities, and stay active across far more market conditions. Carbon DeFi's architecture gives it unmatched efficiency. As Carbon DeFi announced:

This level of efficiency has downstream effects. Traders get tighter pricing and more predictable fills. LPs earn yield from intentional positioning rather than random curve exposure. Protocols can design markets with far less initial capital while still achieving depth and stability. When executed on COTI’s high-performance network, the entire system gains even more throughput and lower latency, allowing strategies to trigger precisely when price conditions are met.

Why COTI Is the Missing Piece

Carbon DeFi already solves the mechanical problems of trading precision, automation, capital efficiency. But COTI fills the one gap even the best DEX architecture can’t fix on its own: confidentiality that works at scale.

Here’s why COTI completes the system:

- Privacy where it actually matters: Traders don’t just need smarter execution, they need a way to keep strategies hidden. Traditional chains broadcast every intention publicly, turning every order into a signal predators can exploit. COTI’s Garbled Circuits encrypt the computation itself, meaning logic, conditions, and triggers stay private until execution.

- Protection against MEV and strategy leakage: Carbon already makes makers immune to sandwich attacks. COTI strengthens that protection by keeping the entire decision layer confidential. Bots cannot copy trades, frontrun logic, or map out liquidity plans because they can’t see them.

- Compliance-ready privacy: ZK systems protect visibility. COTI protects computation. Together, this allows “privacy with rules” where traders maintain confidentiality while still being able to disclose what’s needed for audits or regulation.

- Speed that actually keeps up with Carbon’s engine: Carbon’s architecture moves quickly. COTI’s privacy layer matches that pace. COTI's solution is thousands of times faster than the leading alternative.

- Confidentiality: DeFi strategies require programmable privacy. Limit Orders, Recurring Orders, Range Orders - these are forms of programmable logic. On most chains, that logic is visible and forkable. On COTI, the logic itself stays encrypted. Carbon becomes harder to exploit, easier to customize, and safer to scale.

- The ideal environment for institutional-grade trading: Funds, treasuries, and trading firms can’t operate in environments where every move is public. COTI gives them the privacy they need without leaving the regulatory perimeter. This unlocks new liquidity sources that traditional AMMs can’t attract.

- Synergy with the Arb Fast Lane: Carbon’s solver system needs a fast, predictable settlement layer. COTI provides low latency, deterministic finality, and enough throughput to support high-frequency arbitrage operations. The result is cleaner execution and more active strategies chain-wide.

Carbon DeFi + COTI becomes a private, programmable trading environment - something DeFi hasn't had before. Mark Richardson (Bancor Lead) said it clearly:

Final Thoughts: The DEX Era Just Leveled Up

Carbon DeFi is not here to replace AMMs. It's here to expand what's possible. With Bancor's engineering, COTI's confidential computation, and onchain automation that feels closer to a full trading desk than a swap interface, Carbon DeFi sets a new bar. DeFi needs smarter infrastructure. Traders need real tools. Liquidity needs flexibility, precision, and protection. Carbon DeFi delivers all three - and with COTI, the combination feels like a preview of what the next cycle of DeFi will look like.

If the next wave of decentralized markets is shaped by users who demand precision and confidentiality, Carbon DeFi on COTI is positioned to lead that evolution. It gives traders the toolkit they’ve been missing and sets a new bar for what a modern DEX can be.

READ MORE : What is COTI V2: Revolutionizing Blockchain Privacy with Garbled Circuits