TLDR

- Five spot XRP ETFs from Bitwise, Franklin Templeton, 21Shares, Canary, and CoinShares appear on the DTCC's "active and pre-launch" list.

- DTCC listing is a positive step but not an approval-SEC sign-off is still required.

- Canary Capital's CEO says the firm is prepared to launch its ETF as early as next week.

- Analysts expect multiple XRP ETFs to debut before the end of November due to new SEC listing standards.

- A potential end to the U.S. government shutdown may accelerate ETF approvals across several altcoins.

The race to bring spot XRP exchange-traded funds to U.S. markets is accelerating, and the latest signal has grabbed the attention of analysts, traders, and crypto issuers alike. The Depository Trust and Clearing Corporation (DTCC), the backbone of U.S. securities settlement infrastructure, has listed five spot XRP ETFs under its "active and pre-launch" category-an indication that issuers may be preparing for imminent launch windows.

While the listing does not guarantee Securities and Exchange Commission (SEC) approval, it suggests issuers are far enough along in their filings, operational readiness, and issuer-custodian commitments that they are preparing for a possible November debut. After a year defined by rapid approval cycles for Bitcoin, Ethereum, Litecoin, Solana, and Hedera ETFs, attention has shifted to XRP, one of the longest-standing digital assets with a substantial global following and deep liquidity.

The momentum has been building for weeks, but the appearance of all five major XRP ETF proposals on the DTCC website marks the clearest sign yet that the launch timeline could be short-possibly a matter of days.

The DTCC Signal: Why It Matters, and What It Doesn't Guarantee

The DTCC's website shows spot XRP tickers from Bitwise (XRP), Franklin Templeton (XRPZ), 21Shares (TOXR), Canary (XRPC), and CoinShares (XRPL) listed under the "active and pre-launch" section. In ETF circles, a DTCC listing is often interpreted as a strong operational readiness milestone. It generally means the issuer has completed baseline exchange coordination, custodial setups, and internal controls required before launch.

But it is not an approval. Outside of Bitcoin and Ethereum-whose launches were explicitly greenlit by the SEC earlier this year-altcoin ETFs must still satisfy an evolving regulatory process. This includes risk disclosures, updated S-1 filings, exchange rules, and now the SEC's "generic listing standards," which allow certain ETFs to become effective without a lengthy review period.

This distinction is important: DTCC-ready does not equal SEC-approved. Still, the listing represents meaningful progress. The market noticed. XRP rose over 7% during the weekend as anticipation grew.

Issuers Prepare for Possible Launch in the Coming Week

Among the five issuers, Canary Capital has been the most vocal. According to comments shared at the Ripple Swell event, Canary's CEO Steven McClurg told attendees he expects the firm's XRP ETF to go live soon. McClurg's statement was paraphrased in market coverage: he reportedly said the firm is "fully prepared to launch its spot XRP ETF next week."

That timing aligns with speculation across the ETF community, especially after the SEC implemented its new fast-track structure for certain digital asset exchange-traded products. Earlier this month, two major issuers-Bitwise and Grayscale-revealed their fee structures for their upcoming XRP ETFs, another indicator that the products are nearly launch-ready. Fee announcements tend to occur late in the process, typically within days or weeks of anticipated approval.

Analysts Expect First XRP ETFs Within Days, Not Weeks

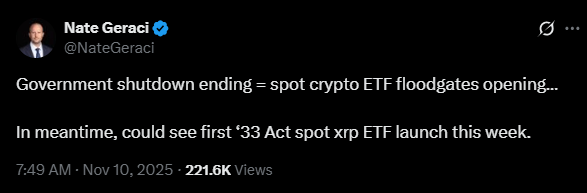

Market analysts have also begun signaling a compressed timeline. On Sunday, NovaDius Wealth Management President Nate Geraci said on X that he expects the first line of XRP ETFs to debut next week.

He wrote:

Geraci's comments reflect rising confidence among ETF observers that the SEC's new generic listing standards will allow XRP ETFs to automatically become effective once issuers update their S-1 filings and meet the rulebook criteria. The U.S. Senate's tentative agreement to end the ongoing government shutdown adds further momentum. The shutdown had significantly slowed the SEC's internal review capacity, delaying several pending ETF filings across multiple altcoins. If it ends this week, analysts believe the SEC's backlog will clear quickly.

This could produce the largest single-month wave of crypto ETF approvals since the debut of Bitcoin ETFs in January.

A Rapidly Expanding Altcoin ETF Landscape

The XRP filings are part of a broader strategic shift among global ETF issuers, who have seen strong demand for altcoin-based products following the success of Bitcoin and Ethereum funds earlier this year.

Recent launches include:

- Litecoin (LTC) - Canary's LTC ETF, first listed on DTCC in February, launched eight months later in October.

- Solana (SOL) - After months of legal and regulatory delay, SOL ETFs finally debuted last month.

- Hedera (HBAR) - A series of HBAR ETFs also launched recently.

Together, they demonstrate a key trend: major asset managers are now racing to build complete crypto ETF product suites, anticipating that mainstream investors will diversify beyond Bitcoin and Ethereum. XRP, one of the most heavily traded digital assets globally, fits neatly into this shift.

Why XRP ETF Demand Is Expected to Be Strong

XRP has several characteristics that ETF issuers find appealing:

- Deep Liquidity: XRP consistently ranks among the top assets by global trading volume.

- Large User Base: XRP has an unusually strong community, often activated around regulatory and institutional milestones.

- Institutional Narrative: Ripple's years-long legal battle with the SEC, followed by partial court victories in 2023, has kept the asset at the center of policy and institutional conversations.

- Cross-Border Use Cases: Unlike many altcoins, XRP has a defined and active payment infrastructure narrative tied to Ripple's enterprise products.

These factors, along with its track record as one of the earliest major crypto assets, make XRP a prime candidate for ETF issuers looking to capture retail and institutional interest beyond the blue-chip majors.

The Regulatory Piece: SEC's New Standards Could Accelerate Everything

A large part of the optimism around a November launch stems from the SEC's adoption of generic listing standards that streamline ETF approvals. The new approach allows issuers to bypass lengthy procedural reviews, so long as their products meet standardized criteria for custody, pricing, and disclosures. This is the same structure used to expedite Bitcoin and Ethereum approvals-and it appears to be extending to select altcoins.

If an issuer's amended S-1 filing meets the criteria, the ETF can automatically become effective without a formal approval announcement. This opens the door to quiet, fast-track listings. It also means that once the U.S. government shutdown is fully resolved, a backlog of ETF applications could move to completion quickly.

Final Thought

The appearance of five spot XRP ETFs on the DTCC's active and pre-launch list signals that issuers are preparing for one of the most anticipated ETF launches of the year. While DTCC listing is not a guarantee of SEC approval, it is an unmistakable sign that the operational groundwork is complete and that issuers are positioned to move quickly. With regulatory momentum building, shutdown delays easing, and market analysts expecting approvals within days, XRP's entry into the ETF arena could mark the beginning of a major new phase in U.S. crypto fund expansion.

READ MORE : What is COTI V2: Revolutionizing Blockchain Privacy with Garbled Circuits