TLDR

- USDX - a synthetic stablecoin issued by Stable Labs - lost its dollar peg, falling below $0.50 and creating ripple effects across DeFi.

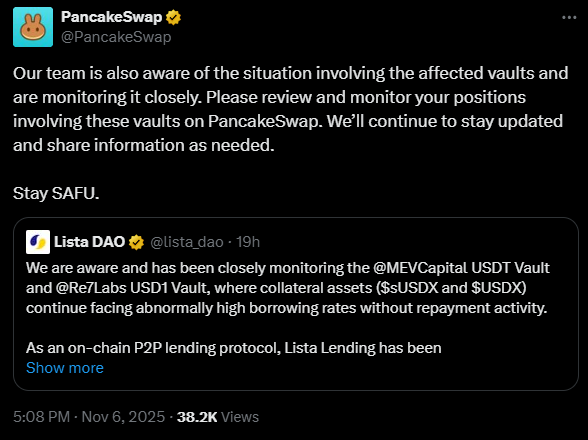

- Lista DAO and PancakeSwap are monitoring affected vaults and warning users of elevated risks.

- The depeg may be tied to liquidations linked to the $128M Balancer exploit, raising questions about USDX's hedging model.

- Stable Labs has not issued a statement, leaving users uncertain and protocols scrambling to manage exposure.

- Emergency actions include vault liquidation, flash loans, and market de-risking.

USDX, the synthetic stablecoin created by Stable Labs, has suffered a dramatic collapse - falling more than 50% below its intended $1 peg. The token, once marketed as a delta-neutral, fully hedged stable asset, is now trading under $0.50, marking one of the most severe depegs in the stablecoin sector this year.

The fallout has touched several major DeFi ecosystems, including Lista DAO and PancakeSwap, both of which have begun issuing guidance, monitoring affected vaults, and coordinating mitigation steps. What began as a sudden drop has now escalated into a full-scale ecosystem stress test, with questions mounting around USDX's model, its exposure to recent exploits, and the silence from its issuer.

A Stablecoin Built on Hedging-Now Deeply Off-Peg

USDX was designed as a synthetic stablecoin using delta-neutral strategies - a method that typically involves hedging long and short positions to maintain a stable value. At its peak, the token reached an all-time circulating supply of $683 million, a large footprint for a non-fiat-backed asset.

But as of Thursday, that model showed signs of breaking. USDX dropped to under $0.50, and its staked variant, sUSDX, fell even lower to roughly $0.49. Centralized exchange BitMart, Uniswap pools, and several DeFi protocols still list the token, leaving users scrambling for clarity and liquidity as volatility accelerates.

Stable Labs - the issuer - has not commented publicly on the incident, adding a layer of uncertainty to the mix.

Lista DAO and PancakeSwap Raise Early Alarms

Two of the largest protocols with exposure to USDX were quick to react. Lista DAO published a detailed warning on X, saying unusual borrowing behavior across USDX-related vaults had triggered internal alerts:

This was followed by a more formal communication, noting that the team was taking precautionary measures and preparing for emergency actions. PancakeSwap issued a similar message, urging users to actively check their positions:

Both statements reflect growing concern about the structural integrity of vaults that depend on USDX or its staked versions for collateralization or liquidity.

A Possible Trigger: Fallout From the $128M Balancer Exploit

Although Stable Labs has yet to comment, one theory is circulating widely in the community: The $128 million Balancer exploit on Nov. 3 may have indirectly affected USDX's hedging engine. According to early hypotheses, the exploit could have forced liquidations of BTC and ETH short positions used by Stable Labs to hedge USDX. If true, these liquidations may have:

- Eliminated hedge positions

- Triggered redemptions

- Created liquidity crunches

- Caused cascading depegs

While unconfirmed, the timing aligns closely with USDX's collapse and the sudden, sharp rise in borrowing rates noted by Lista. More detailed blockchain analysis will likely emerge in the coming days.

Emergency Measures: Liquidations, Flash Loans, and Rapid Unwinding

As the depeg intensified, Lista DAO quickly called an emergency proposal to liquidate its USDX/USD1 vault - a move designed to prevent further contagion. The team's announcement framed the action as protective:

Working with Re7 Labs, which originally helped design the vault, Lista executed a flash loan to facilitate a rapid unwind of USDX positions.

The liquidations were substantial:

- 3.5 million USDX liquidated

- 2.9 million USD1 recovered

The emergency steps were deployed to stabilize the broader lending markets tied to the vault. For now, the intervention appears to have slowed further deterioration - but it may not fully contain the fallout if USDX continues to slip.

Integration Footprint: How Big Is the Risk?

USDX is integrated across numerous DeFi ecosystems - not just lending platforms like Lista, but DEXes, staking protocols, and yield vaults. This means the depeg risks spreading via:

- Collateral shortfalls

- Underwater lending positions

- Impaired liquidity pools

- Liquidation cascades

- Vault insolvency

Thus far, the damage appears contained to USDX-related vaults and pools, but any continued price drop could widen the impact. Protocols monitoring exposure include:

- Lista DAO

- PancakeSwap

- BitMart

- Uniswap liquidity providers

- Smaller synthetic asset platforms

- Yield aggregators that used sUSDX

Crypto markets are currently watching liquidity flows closely to assess whether the depeg spreads to other assets.

The Silence From Stable Labs

One of the most concerning elements is the lack of an official statement from Stable Labs. Given the scale of USDX's depeg and its integration footprint across multiple chains, users and partner protocols are expecting:

- A technical explanation

- Status of hedging positions

- Clarification on reserves

- Details on redemption processes

- Next steps for recovery

Until then, the market is left piecing together blockchain activity and protocol announcements. The longer the silence continues, the more confidence deteriorates.

Final Thoughts

USDX's collapse below $0.60 marks one of the most significant synthetic stablecoin breakdowns of 2025. Protocols such as Lista DAO and PancakeSwap are taking fast, responsible action, but the absence of communication from Stable Labs leaves the ecosystem exposed to uncertainty.

As DeFi integrations grow more interconnected, failures like this highlight the need for stronger risk visibility, transparent collateral models, and clearer crisis protocols. More updates are expected as exchanges, validators, and partner protocols continue to investigate the root cause and monitor the unfolding impact.