TL;DR

-

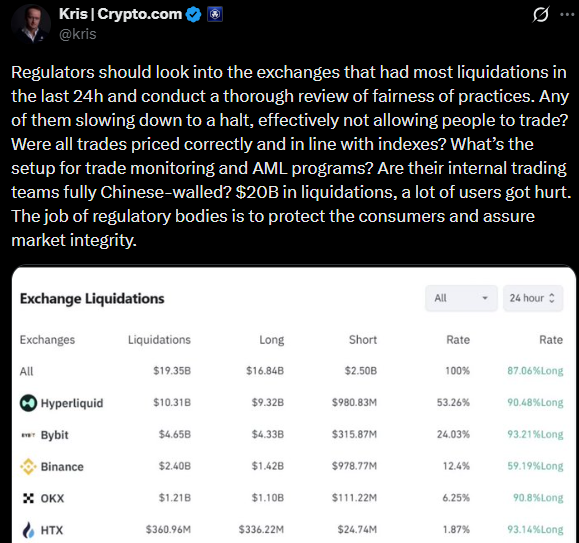

Kris Marszalek, CEO of Crypto.com, has called on regulators to investigate exchange practices after $20 billion in liquidations swept the market in 24 hours.

-

He questioned whether platforms "slowed down to a halt," mispriced assets, or failed anti-manipulation safeguards during the crash.

-

Binance confirmed a depeg event involving Ethena's USDe, BNSOL, and WBETH, triggering forced liquidations.

-

The exchange says it will review affected accounts and compensate verified errors.

What unfolded in crypto markets over the past day has few precedents. With nearly $20 billion in liquidations, the scale of destruction has shaken confidence-and now the head of one major exchange wants answers. In a post on X, Crypto.com CEO Kris Marszalek urged authorities to launch a deep investigation into the exchanges most affected. He asked whether some platforms intentionally slowed down trading, mispriced assets, or failed to uphold basic compliance and anti-manipulation standards.

His move is bold-but not without precedent. During sudden crashes, questions often emerge about how exchanges handled order flows, matching engines, and risk systems. This time, the scale demands scrutiny.

The Liquidation Landscape: Who Wiped Out Most

Data from CoinGlass paints a stark picture:

- Hyperliquid suffered the largest blow, with $10.31B in liquidations

- Bybit followed with ~$4.65B

- Binance recorded ~$2.41B

- Other platforms like OKX, HTX, and Gate.io also saw significant losses.

These numbers aren't just a reflection of leverage-they suggest that volatility, collateral mechanisms, and platform-specific parameters played a decisive role in how the carnage unfolded.

Binance's Depeg Incident: Catalyst for Some Pain

Binance later confirmed that a price depeg event involving USDe, BNSOL, and WBETH triggered forced liquidations for many users. The exchange said it's currently reviewing impacted accounts and will enact "appropriate compensation measures."

In one user complaint, a trader claimed their short position was fully closed while the long remained open, resulting in total loss. The trader insisted this was not due to auto-deleveraging (ADL). Binance co-founder Yi He addressed the issue publicly, attributing user losses to "significant market fluctuations and a substantial influx of users." She offered to compensate verified cases tied to platform errors, though she clarified that losses derived from pure market moves or unrealized profit changes would not qualify.

Further, Binance's official support notice confirmed that the depeg event affected USDE, BNSOL, and WBETH, and that compensation would be handled for futures, margin, and loan users impacted between specific timestamps.

How This Crash Compares to History

Analysts and market commentators were quick to draw comparisons. One crypto analyst noted:

Indeed, this event dwarfs many prior crypto market upheavals-and raises intense questions about leverage, platform stability, and systemic risk in DeFi and CeFi ecosystems.

Final Thought

With losses this staggering, the push for accountability is understandable. Marszalek's call adds momentum to whistleblower pressure and highlights a central truth: in ultra-volatile markets, the integrity of the exchanges matters just as much as traders' strategies.

If regulators respond-and platforms reform-this crash might be remembered not only for its size but for the course correction it forced on market structure and oversight.

READ MORE: Top Mid Cap 7 Coins to Invest In For 2025