TL;DR

- The rise of "intent‑based architecture" marks a major shift in DeFi - users say what they want, and the system handles how to do it.

- PriveX is the first intent‑based perpetual DEX built on the COTI Privacy Network, using encrypted intents, solver‑networks and just‑in‑time liquidity.

- Without this model, on‑chain trading still suffers from visible orders, MEV and liquidity fragmentation - PriveX addresses all three.

- The article explores what intent‑based architecture actually means, why it matters for on‑chain derivatives, how PriveX implements it, and why you should be paying attention.

If you've followed decentralized finance for a while, you know there's a gap between the promise and the reality when it comes to derivatives trading on‑chain. Perpetual futures are huge - the total volume across perp DEXs runs into the tens of billions daily - yet most traders still use centralized exchanges because the user experience, liquidity and execution simply beat what many on‑chain platforms offer.

On one side you have centralized exchanges (CEXs) offering deep liquidity and familiar UX, but with trade‑offs: custody risk, opaque operations, KYC, and centralisation. On the other side you have many decentralized platforms where you maintain self‑custody and decentralization but face slower execution, higher slippage, exposed strategies and MEV (Miner/Max Extractable Value) risk. The missing piece has been a platform that gives CEX‑like performance but stays true to DeFi principles.

Enter the concept of intent‑based architecture. Instead of making users specify every step of a transaction - which liquidity pool, which path, how to hedge - the system lets the user express what they want to achieve, and the protocol handles the execution. That promises to reduce friction, improve execution and hide your strategy until execution. For on‑chain derivatives, where large trades and aggressive strategies abound, that can be a game‑changer.

And this is where PriveX comes in. Built on COTI's privacy network, it layers encrypted intents, solver‑networks, just‑in‑time liquidity and non‑public execution to deliver a new step in on‑chain trading.

What Is Intent‑Based Architecture?

At its core, Intent‑based architecture flips the relationship between user and protocol. Instead of asking users to provide every detail of a transaction - the pool, the path, the slippage, the collateral, the hedge - the protocol asks: What do you want to achieve?. The user then expresses that intent (for example, "I want to long 1 BTC with 10× leverage" or "I want to swap token A for best possible price"), and the system takes care of the rest: sourcing liquidity, executing the trade, managing collateral, optimizing gas and routing.

This abstraction brings several important benefits:

- It simplifies the experience for users who might be deterred by complex DeFi flows.

- It allows the protocol to optimize behind the scenes: choose the best path, reduce gas cost, pick the best liquidity source.

- It hides strategy from public view - the intent may be visible but the execution path, linkage and counterparty are obscured or encrypted.

- It sets the stage for advanced applications such as AI‑agents, algorithmic trading, multi‑step workflows (e.g., cross‑chain, staking + trade) without forcing the user to handle each step.

In traditional DeFi you might watch: choose DEX A or B, check pool liquidity, check slippage, approve token, execute transaction, maybe bridge, maybe hedge. With intent‑based architecture you say: "I want X outcome" - the system handles path‑finding, liquidity, execution, maybe anchored on‑chain settlement. The user cares about outcome rather than mechanics.

In the context of blockchain architecture, this can be the difference between onboarding barrier (for less technical users) and a more intuitive experience - which in turn can open DeFi to a broader audience.

Why It Matters for On‑Chain Trading

When applied to derivatives, especially perpetual futures, intent‑based architecture addresses multiple structural issues:

Liquidity & Execution

Many on‑chain perpetual platforms rely on automated market‑makers (vAMM) or order books with limited liquidity. These can face slippage, fragmented liquidity, and inefficient pricing. An intent‑based model can pull liquidity from various venues dynamically, commit capital only when needed ("just‑in‑time"), and avoid idle capital being locked in pools.

Strategy Exposure & MEV Risk

On chain, one of the biggest invisible costs is strategy leakage. When an order appears in the mempool or an open book, bots can front‑run, sandwich trades and target liquidations. That affects large traders and institutions in particular. With intents encrypted or hidden until execution, those risks shrink.

User Experience

Traditionally, trading perps or complex DeFi workflows require multi‑step processes: approve token, choose market, set leverage, choose collateral, maybe hedge after. That puts a burden on the user. With intent architecture, the protocol absorbs that burden, letting the trader focus on purpose rather than mechanics.

Accessibility & Innovation

Lowering the mechanics barrier means more users can participate, and protocols can layer new features like AI‑trading agents, social strategies, algorithmic workflows. That in turn compounds usage, liquidity and innovation.

In short: intent‑based architecture brings the next evolution in how trading infrastructure can look on‑chain - fast, efficient, private, user‑centric.

How PriveX Implements Intent‑Based Architecture

PriveX takes this architecture and applies it to the mirrors of derivatives trading, built on the COTI Privacy Network. The implementation proceeds through several layers:

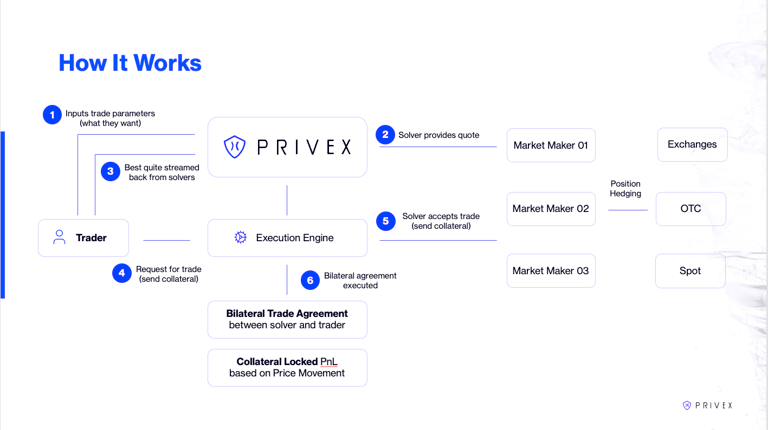

How PrivEx Works

At its core, PrivEx reimagines how trading happens on‑chain - replacing open order books and public liquidity pools with a private, bilateral structure that protects both sides of a trade.

Source : PriveX Docs

It starts with the trader, who simply inputs the trade parameters - what asset they want to buy or sell, and in what size. Once that happens, the request moves to PrivEx's execution engine, which broadcasts it privately to a network of professional liquidity providers known as solvers. Each solver responds with a quote. PriveX instantly identifies and streams back the best available quote to the trader. The trader can then choose to accept, sending collateral into the execution engine to confirm the trade request.

If the solver agrees, they also post collateral - and that's when things get interesting.

PrivEx forms a bilateral trade agreement between the trader and the solver. No middlemen. No public ledgers showing open orders. Everything is locked and settled privately through collateralized PnL, meaning both parties' exposure is secured based on the price movement. Behind the scenes, solvers manage their position hedging through external venues - exchanges, OTC desks, or spot markets - ensuring risk neutrality while keeping the on‑chain trade confidential.

In essence, PrivEx turns every trade into a private contract - an invisible order book for the on‑chain era - blending privacy, collateralization, and liquidity into a single seamless mechanism. This is how the future of on‑chain trading unfolds: fast, bilateral, and unseen.

Solver Network & Just‑in‑Time Liquidity

Once the intention is captured, it goes to a network of solvers - professional liquidity providers who supply quotes, collateralise exposure and execute trades when conditions align. Liquidity isn't locked up beforehand in large pools; instead, it is committed at execution. The model brings capital efficiency: fewer locked funds, less wasted TVL, immediate quoting and execution. Docs from PriveX themselves say they are "100× more efficient than existing vAMM derivatives exchanges."

Encrypted Execution & Privacy Layer

Built on COTI's Privacy Network (leveraging garbled circuits), PriveX ensures that your trade intent, collateral, risk parameters and the routing or execution logic remain encrypted until final settlement. This means that bots, front‑runners or other adversaries can't inspect your trade strategy ahead of time.

Bilateral Settlement, Cross‑Margin & UX

Instead of relying on traditional LPs, PriveX forms direct bilateral agreements: you and a solver each post collateral, the trade is settled based on price movement. On top of that, the platform supports cross‑margin accounts (shared collateral across multiple positions) and sub‑accounts, giving you flexibility. The front‑end is built for ease: one‑click trades, mobile‑friendly PWA, gas‑auto handling, and intuitive dashboards.

Deep Liquidity Bridge

Because solvers can source liquidity from multiple venues - including major CEXs - PriveX claims to bring CEX‑like execution to on‑chain. The intent‑engine connects you to best pricing across venues without exposing your strategy. (Chainwire press release: "execution is handled by a backend solver network ... which sources liquidity from a mix of centralized and decentralized venues, including Binance.")

Why It's a Game‑Changer

Privacy, but for Traders

We often hear about privacy in DeFi, but rarely in the context of trading infrastructure. With most platforms, your large order, stop‑loss level, liquidation margin, hedge strategy may become visible before or during execution. That invites loss of edge. With an encrypted intent model you safeguard your strategy itself. That elevates the playing field particularly for serious traders and hedge funds.

Capital Efficiency & Scalability

Because liquidity is engaged only when needed, capital is not locked in idle pools. Solvers commit when they accept the trade. That means more efficient use of capital, ability to handle large orders with less slippage and better scalability across asset classes and chains.

UX that Bridges CEX and DeFi

One of the big user barriers in DeFi is complexity: approving transactions, choosing paths, managing gas, bridging networks. PriveX hides much of that complexity behind the intent model and user‑friendly interface, while still delivering on the decentralisation promise. That makes it appealing for mainstream adoption.

Prepared for the Next Wave (AI + Multi‑Chain)

PriveX isn't standing still. The architecture supports future integrations: AI trading agents (so your intent might say "deploy my trained AI agent to take positions"), multi‑chain expansion, advanced order types and automation. That positions it for the next generation of trader demands.

Considerations & What to Keep in Mind

While the model is compelling, some practical considerations remain:

- As a relatively new platform, ecosystem maturity, liquidity depth for niche markets, and real‑world user volumes may still be ramping up.

- Even with privacy layers, derivatives trading carries inherent risk: leverage, margin mechanics, liquidation triggers, collateral posting all require diligence.

- The solver network and architecture introduce novel counter‑parties (solvers) - understanding how this works, risk management and transparency is still essential.

- Regulatory & jurisdictional aspects of privacy trading, derivatives and self‑custody may vary - users should assess local law and compliance obligations.

- Early platforms often evolve rapidly - features may change, UX may mature, incentives may shift, so staying updated matters.

Looking Ahead

The move to intent‑based architecture is not just a single platform innovation - it reflects a broader shift in how blockchain applications will operate. As the user base for DeFi broadens beyond highly technical users, tools which abstract complexity will lead to greater adoption. Stripping away friction, hiding technical plumbing from the user while preserving trust and decentralisation is a winning formula.

For derivatives, which traditionally live in the world of high speed, high volume and institutional users, bringing an on‑chain model that retains performance and privacy could unlock a large swath of capital that has so far stayed in CEXs. PriveX is one of the early movers in this domain. Whether it becomes the standard, or one of several platforms embracing this model, is yet to be seen - but the architecture is ready and the appetite is there.

Conclusion

Intent‑based architecture is more than a buzzword - it's a foundational upgrade to how decentralized finance can operate. By enabling users to express what they want and relying on the system to handle how, platforms can drastically simplify UX, reduce cost and preserve strategy confidentiality.

For traders in the perpetuals space who have felt restricted by leakage, slippage, hidden costs and operational complexity, PriveX represents a new option. Built on COTI's privacy layer, using encrypted intents, solver‑networks and just‑in‑time liquidity, it makes a serious attempt at delivering "CEX‑grade execution on‑chain, with DeFi's decentralisation".

If you're looking at the next generation of on‑chain trading infrastructure, and value strategy confidentiality, capital efficiency and performance, it's worth exploring. The architecture is ready - and the user experience may just be too.

READ MORE : COTI V2’s Secret Weapon: Garbled Circuits Explained for the Web3 Era