TL;DR

- U.S. spot XRP ETFs have now logged 13 straight days of net inflows since launching on Nov. 14.

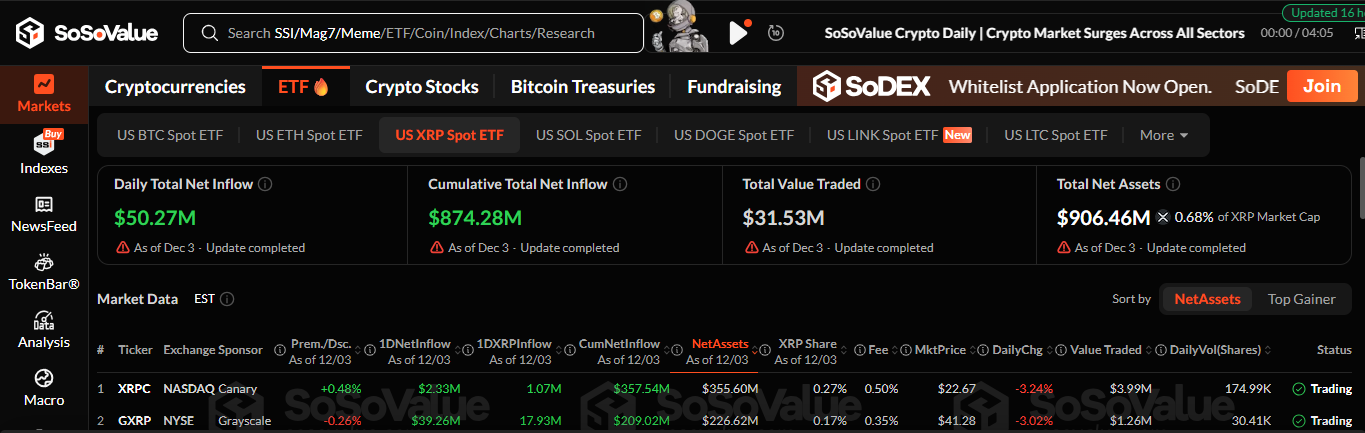

- The products added $50.27 million on Dec. 3, pushing total net inflows to $874.28 million.

- XRP ETFs are on pace to hit the $1 billion milestone in under a month, positioning them among the fastest-growing crypto ETF categories.

- Wednesday's trading volume reached $31.53 million, showing steady participation from traditional finance markets.

- The broader crypto ETF sector remains active - Solana ETFs have crossed $600 million, while Bitcoin and Ether ETFs continue dominating with $58B and $13B in inflows respectively.

XRP's 13-day inflow streak isn't just a chart-friendly headline. It tells a bigger story about how U.S. investors are behaving now that crypto ETFs have become a normalized part of traditional finance. Spot bitcoin funds already proved that investors want exposure to crypto through familiar wrappers. Ether's ETFs doubled down on that trend. Now XRP is showing that demand isn't limited to just the largest assets.

The near-$1 billion inflow mark - hit in under a month - shows that XRP has a real foothold inside a market segment usually dominated by BTC and ETH. That pace would have been unthinkable just a year ago, especially given the long regulatory standoff surrounding XRP's classification. But once investors were given a compliant and convenient entry point, capital started moving quickly and consistently.

This is also the first time an altcoin ETF has shown a multi-week streak of uninterrupted inflows at this scale. It puts XRP on a different tier compared to most other non-BTC/ETH assets, even those with strong ecosystems. For institutional allocators who move slowly but decisively once a pattern becomes obvious, this type of data tends to shift XRP from a niche asset toward a more "core satellite" position inside multi-asset crypto portfolios.

How XRP Is Benefiting from the Broader ETF Wave

The ETF boom is not slowing down. Solana's spot ETFs have already crossed $600 million in inflows. Dogecoin and Litecoin ETFs have followed with smaller but steady demand. Analysts like Eric Balchunas expect "over 100" new crypto ETFs to hit the market in the next six months. That alone signals how aggressively issuers are preparing for a new phase of tokenized investment products. XRP is benefiting from this environment in two ways.

First, investors who already trust the ETF format are less hesitant to explore options beyond bitcoin. Once ETFs replaced the onboarding friction with a familiar brokerage interface, the barrier between "I like the idea of crypto" and "I'll buy exposure now" almost disappeared.

Second, the presence of other altcoin ETFs makes XRP look like part of a larger institutional trend rather than an isolated experiment. Investors are allocating to crypto the same way they allocate to sectors - spreading exposure across multiple assets that each serve different use cases.

The Liquidity Angle: Why TradFi Cares

Liquidity is the quiet metric that matters most to institutional players. The daily volumes for XRP ETFs - over $31.53 million on Dec. 3 alone - give funds the confidence that they can enter and exit positions without excessive slippage. This is the same dynamic that helped turn bitcoin ETFs into one of the most successful ETF launches in U.S. history.

As XRP volumes rise, it improves the long-term case for even larger allocators such as pensions, endowments, and insurance structures. These institutions don't move first. They move when liquidity becomes too obvious to ignore.

XRP's inflow streak strengthens exactly that narrative.

A Broader Market Turning Point

BTC ETFs are nearing $58 billion in cumulative inflows. ETH ETFs have drawn about $13 billion. Solana ETFs passed $600 million. XRP ETFs are closing in on $1 billion - and they did it in their first month.

When you zoom out, the trend is obvious: the U.S. market is rapidly normalizing crypto exposure inside traditional finance. The presence of multiple high-performing crypto ETFs signals a more mature, multi-asset environment. Investors aren't treating crypto like a single bet anymore. They're treating it like an asset class.

And XRP is shaping up to be a major part of that structure.

Looking Ahead

If inflows continue at anything close to their recent pace, XRP ETFs could finish their first full quarter with numbers far beyond initial expectations. This would put XRP among the top-performing new ETFs of the year - not just in crypto, but across the entire U.S. ETF industry.

The path from here depends on market sentiment, broader crypto performance, and how quickly new issuers roll out competing products. But the foundation is already strong: steady inflows, consistent volume, and a growing class of investors who now see XRP as a legitimate, ETF-ready asset.